Table of Contents

AndreyPopov

Investment action

I advised a acquire rating for Academy Sports activities and Outside (NASDAQ:ASO) when I wrote about it the past time, and as I expected, the analyst working day has reinforced my optimistic outlook on the company. Based mostly on my existing outlook and analysis of ASO, I reiterate a get score. I be expecting administration to persuade the current market that they can execute on their announced approach during the analyst day. I believe that proof of this kind of achievements will be noticed in 2H as administration navigates the enterprise to fulfill today’s consumers’ calls for.

Qualitative overview

The very first quarter was a terrible efficiency. 1Q modified EPS came in at $1.30, below the $1.66 expected by consensus. The $1.38 billion in profits missed estimates for $1.44 billion, and the -7.3% SSS skipped consensus estimates for -3.6%. Finally, the altered functioning margin of 9.9% was also reduce than the predicted 12.4%. As a end result, administration decreased FY23 profits and earnings projections.

My faith in management’s capacity to execute has been slightly shaken by this dismal quarter they seem to have mispositioned the organization from the get-go. Professionals cited sluggishness in revenue of superior-priced seasonal groups like patio home furniture and h2o sporting activities as a principal lead to of the revenue shortfall. Weak spot in income of other higher-priced, long-replacement-cycle items like kayaks and treadmills also contributed significantly. Although apparel and footwear did greater and acquired some unit share in outside, I considered it was apparent not to pursue revenue of substantial ticket items in mild of the present inflationary local climate, which has lowered consumers’ discretionary investing finances.

Despite the dismal performance in 1Q, I am offering the firm one more quarter to see how the administration bargains with the preferences of their clients. As the craze toward more cost-effective products proceeds, I foresee that administration will emphasize delivering “value” to shoppers. This can consider quite a few designs, which include promotions, markdowns, and non-public label gross sales. The issue is that although ASO has succeeded in groups the place the higher rate factors are justified by innovation, they have failed miserably in groups in which this is not the circumstance. Consequently, if management are unsuccessful to show benefits of them conference present day buyer desire, I will become additional skeptical of how well ASO will cope with the recent local weather though also employing the new technique it announced.

What I imagine is very good for the stock is that development in the 2nd 50 percent of the yr will glimpse much better in the headlines. In distinct, the second 50 % of the year would have a lot more favorable sequential comparisons, much less punishing temperature, the introduction of new brands to possibly pique consumers’ interest, possibly productive strategies personalized to the latest current market, and a a lot more sturdy capacity to concentrate on shoppers digitally, all of which ought to drive an increase in sequential gross sales. How the stock would overall performance would probable track how administration is successful in executing these initiatives.

Quantitative examination and Valuation

ASO is creating favourable earnings hence, I am making use of a forward PE numerous to compare the small business from friends. ASO is buying and selling at 7.4x forward earnings right now, which is in line with the common numerous that peers’ are buying and selling at (Dick’s Sporting Goods and Hibbett).

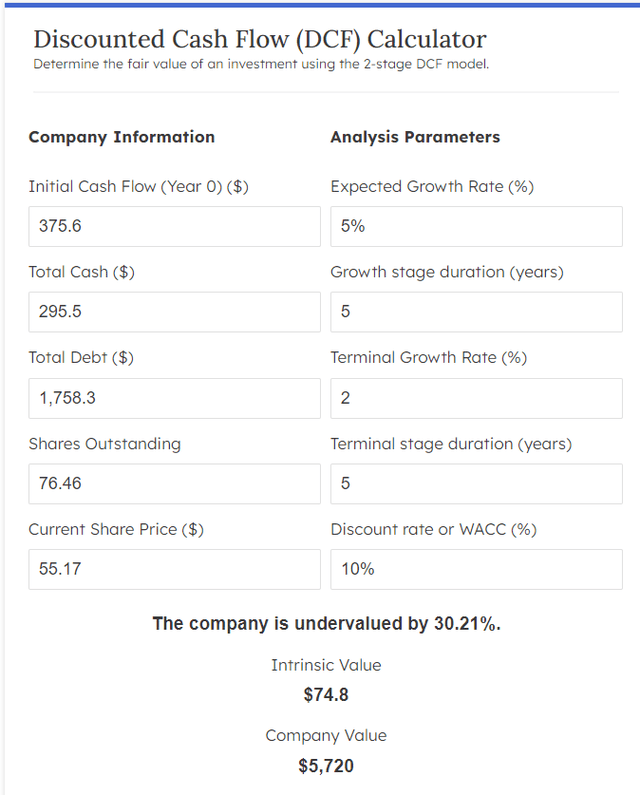

I feel ASO’s new method will allow the business enterprise to expand FCF in the mid-solitary digits for the foreseeable potential (the expansion many years), adopted by a deceleration to 2% (inflation level) as it matures in its terminal yrs. I feel development will not exceed GDP progress by a huge magnitude given the mother nature of the organization (it is not a higher growth business enterprise). My easy DCF design suggests that ASO’s intrinsic worth is $74.80 for each share, with an upside of 30%.

Finmasters

Danger and last thoughts

If Nike sees ASO as just another generic retail companion, they may come to a decision to minimize off item distributions to ASO entirely. If Nike solutions were being no extended offered, it could damage ASO’s monetary effects and inventory cost mainly because of a fall in prospects and sector share. Also, ASO’s omnichannel capabilities are inferior to people of competition. There is a chance of ASO dropping clients and current market share irrespective of its best initiatives to greatly enhance its electronic presence and omnichannel abilities.

Despite the challenging overall performance in the first quarter, my self confidence in management capacity to execute its method remains cautiously optimistic. When the disappointing quarter lifted fears about mispositioning and reliance on higher-priced seasonal groups, I imagine the organization warrants a different quarter to adapt to shifting consumer preferences and emphasize furnishing “worth” to shoppers. The good results of ASO’s new system will likely establish its development trajectory and inventory efficiency.

More Stories

Cailtin Clark Signals Agreement with Sports Administration Business

Iowa women’s basketball guard Caitlin Clark symptoms with Excel Sports activities Administration

Iowa’s Caitlin Clark signs with Excel Sports Management for NIL illustration